A check is a document which is dated, written, and signed, that instructs a bank to pay money from the writer of the check, the payor, to the bearer, or payee, of the check. The check is printed by the drawing bank for the account holder to use. The payor signs the check and then presents it to the payee. They can use it to request cash or deposit money into their account. The amount for which the check was written can be used as a substitute for physical currency.

Do you need to use checks?

Because some transactions still require checks, they may be helpful in some situations. Some landlords will insist that tenants pay rent with a check. Small businesses may not accept debit or credit cards. Also, checks or cash may be a better option than credit cards if you want to be more disciplined about your spending.

You can use checks to pay bills, make gifts, or transfer money between people or entities. Checks are considered safer than cash when transferring large amounts of money. A check that is stolen or lost is not legally able to be cashed by others. The individual or company you are paying is the only one who can cash the check.

For example, if you were going to pay your rent, it is safer writing a check to pay than to withdraw $1000 if you are going to pay cash. Since someone could take the cash if you lose it.

However, checks don’t have these problems. The landlord would rightfully be the only one who could deposit the check or cash it. No one could legally cash or use a $1000 check if you dropped it. Though, you should still be cautious with checks once they have been written, since they are a financial document.

What’s on the check?

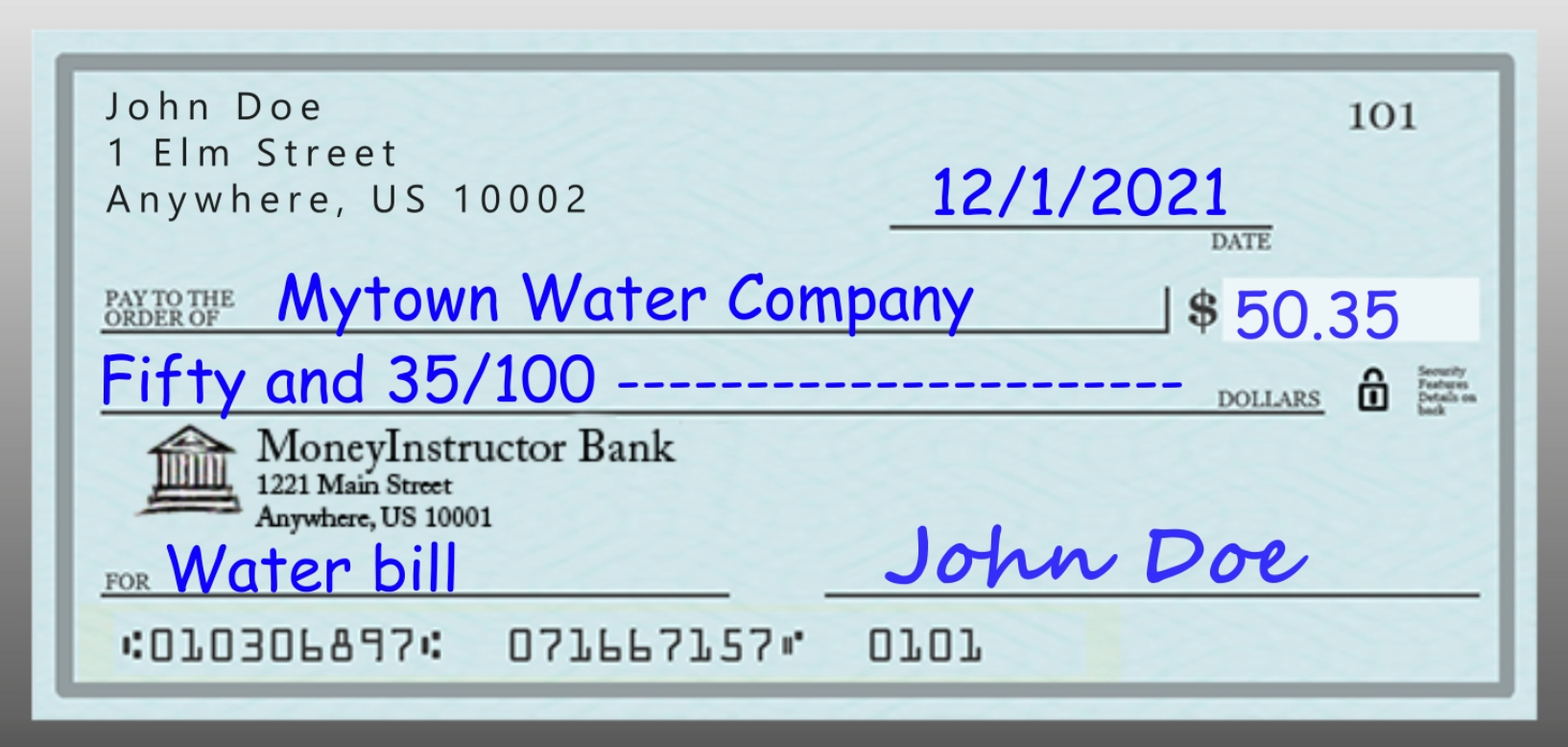

Although checks may not look identical, most share the same basic parts. On the top left-hand corner, you will find the name and contact information for the person who wrote the check. Below, you will also find the name of the bank holding the payor’s account on the check.

The payor must fill in a variety of lines:

- The check’s top right corner will have the date written.

- The check’s first line should include the name of the payee and is indicated with the phrase “Pay to The Order Of”.

- In the box beside the name of the payee, is the amount of the check in dollars.

- The line below the name of the payee shows the amount in words.

- Payor signs the check in the lower right corner. To be valid, the check must be signed.

- A memo line is located in the bottom left corner of the check, below the information for the drawing bank. It can be used by the payor to enter any relevant information such as a reference or account number or any other reason for writing the check.

- Below the memo line and payor’s signature lines, a series of coded numbers can be found on the bottom edge. These numbers are the routing number of the bank, the check number and the account number of the payor.

Make sure you are familiar with all the information found on a check.

In summary, a check is a more secure way to pay than cash and provides you with a receipt. For many financial transactions, you will need to be able to write and use checks.

Lesson Resource

- What is a Check Lesson – Teaching lesson plan for this lesson.

Personal checks can be useful because some transactions still require or are best suited for checks. Landlords, for example, may insist that tenants pay their rent with a check. You may also choose to use checks if you’re mailing money to someone since there’s less risk of the funds being stolen than if you send cash.