Accounting is a process-oriented task that follows a prescribed series of steps in order to keep track of, and record, the balances of the various accounts.

When a business makes a transaction, the effect of that transaction is recorded in the accounting system. According to the fundamental accounting equation, each transaction will affect at least two accounts and the balances in those accounts will change.

When a business makes a transaction, the effect of that transaction is recorded in the accounting system. According to the fundamental accounting equation, each transaction will affect at least two accounts and the balances in those accounts will change.

Accounting is the process of keeping track of those changes and recording and then reporting them.

The Accounting Process

Transaction Example: On August 2, 2005 Tom’s Plumbing purchased a truck for $25,000 with a $5,000 cash deposit and a $20,000 bank loan.

There are three accounts affected:

- The asset account “Truck”

- The asset account “Cash”

- The liability account “Bank Loan”

These specific accounts can be found in what is called the Chart of Accounts. The titles, “Truck” “Cash” and “Bank Loan” are not random these are specific accounts that have been identified as relevant to the entity before it began operations.

Chart of Accounts

The Chart of Account is list of all the accounts used by an entity to record financial transactions. The accounts are grouped according to type and then numbered using the following conventions:

Asset 101-199

Liability 200-299

Equity 300-399

Revenue 400-499

Expense 500-599 (some systems use 600’s)

When numbering accounts it is important to leave gaps between the numbers in order to accommodate additional accounts as required.

Tom’s Plumbing

Chart of Accounts

Asset Accounts Revenue Accounts

101 Cash 410 Repair Revenue

105 Accounts Receivable 420 Supply Sales Revenue

110 Prepaid Insurance

115 Supplies Expense Accounts

120 Equipment 501 Advertising Expense

125 Truck 505 Equipment Rental Expense

510 Insurance Expense

Liability Accounts 520 Interest Expense

200 Bank Loan 525 Maintenance Expense

205 Accounts Payable 530 Miscellaneous Expense

210 Taxes Payable 535 Supplies Used

540 Rent Expense

Equity Accounts 545 Utilities Expense

301 Common Stock 550 Truck Expense

305 Retained Earnings 555 Wages and Salary Expense

310 Drawings

360 Income Summary

Once you have identified the proper accounts involved, you need to apply the rules of transaction analysis:

- Asset and Expense accounts are increased by a debit and decreased by a credit.

- Liabilities, Equity, and Revenue accounts are increased by a credit and decreased by a debit.

Using the same transaction example: On August 2, 2005 Tom’s Plumbing purchased a truck for $25,000 with a $5,000 cash deposit and a $20,000 bank loan:

The Truck account is DR $25,000

The Cash Account is CR $5,000

The Bank Loan is CR $20,000

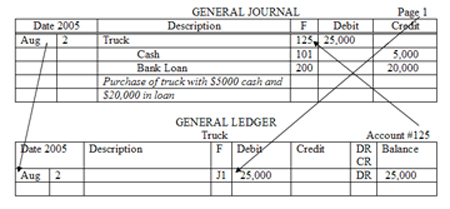

Rather than show these transactions in separate t-accounts, we use a General Journal that records business transactions in a chronological order. The journal also allows us to make notes and is a source of reference should an issue with a transaction arise later.

The General Journal

The General Journal is called the book of original entry and the process of recording transactions in the journal is called journalizing. The following are the steps for journalizing transactions:

- The year is recorded at the top of the page and the month is recorded on the first line in the first column of the date section. This information is repeated for every new journal page.

- The date of the first transaction is entered in the second column in the date section.

- The name of the account(s) to be debited is entered in the description column and the amount of the debit is recorded in the Debit column. When more than two accounts are involved in the transaction the entry is called a compound entry.

- The name of the account(s) to be credited is entered on the next line and indented. The amount of the credit is recorded in the Credit column.

- An explanation of the transaction is included in the description column on the line below the credit entry.

GENERAL JOURNAL

|

Date 2005 |

Description |

F |

Debit |

Credit |

|

|

Aug |

2 |

Truck |

25,000 |

||

|

Cash |

5,000 |

||||

|

Bank Loan |

20,000 |

||||

|

Purchase of truck with $5000 cash and |

|||||

|

$20,000 in loan |

|||||

On August 5, Tom’s Plumbing made revenue from repair service of $1,000 and from supply sales of $255. $560 was received in cash and the rest was in accounts receivable.

GENERAL JOURNAL

|

Date 2005 |

Description |

F |

Debit |

Credit |

|

|

Aug |

2 |

Truck |

25,000 |

||

|

Cash |

5,000 |

||||

|

Bank Loan |

20,000 |

||||

|

Purchase of truck with $5000 cash and |

|||||

|

$20,000 in loan |

|||||

|

5 |

Cash |

560 |

|||

|

Accounts Receivable |

695 |

||||

|

Repair Revenue |

1000 |

||||

|

Supply Sales Revenue |

255 |

||||

Record revenue for the day |

|||||

|

|

|||||

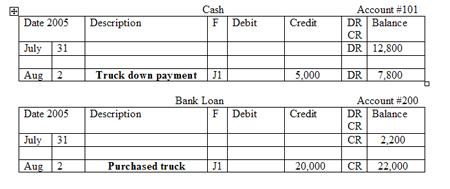

Having a chronological record of the business’ transactions is very useful should you need to go back and review a particular transaction at a later date. The problem with keeping information in this format though, is that there is no way to determine what the actual balance in each account is after each transaction. For example, business owners and managers need to know how much cash is actually in the cash account, and thus in the bank account, at any given time. To keep track of account balances, accountants use what is called a General Ledger.

General Ledger

The General Ledger is the formalization of the t-accounts. The General Ledger consists of ledger accounts, one for each account set up in the Chart of Accounts. Debits and credits to each account are posted to the ledger from the journal and the balance is kept current. Posting is the process of transferring amounts from the general journal to specific general ledger accounts. Because entries are recorded in the ledger after the journal, the general ledger is often called the book of final entry.

The posting process is as follows:

- The date and amount of a journal transaction are posted to the appropriate ledger account.

- The journal page number is recorded in the ledger account’s folio (F) column as a cross-reference.

- The appropriate ledger account number is recorded in the folio (F) column in the journal after the posting has been made.

- The balance of the ledger account is calculated and recorded in the Balance column with a DR or CR in the appropriate column indicating what type of balance it is.

- The description column is used to record anything noteworthy that should be immediately available to readers of the ledger.

Note the account balances from the previous month in the Cash and Bank Loan accounts. The “Balance” column is used to keep a running total of the account balances.

The journalizing and posting process are the first two steps of the entire accounting cycle. The remaining two steps are to take the account balances in the ledger and prepare a Trial Balance and then use those account balances to prepare the financial statements.

For a teaching lesson plan for this lesson see:

Record Keeping and the Accounting Process Lesson Plan